The crisis that broke out between Hamas and Israel has a regional and global impact. Here, as a European Threat Intelligence provider, we analyze the main cyber and geopolitical takeaways of the situation for oil and gas European companies during Cybersecurity Gas Week.

On 7 October, Hamas and its ally, the Palestinian Islamic Jihad, launched a coordinated land, air, and sea attack against Israel.

Hamas launched thousands of rockets against Israeli territory while more than 1000 combatants infiltrated at least 22 locations within the country, shooting at civilians and military personnel and capturing at least 200 hostages. Hamas’ operation is the most sophisticated and deadly attack against Israel led by armed groups. The Israeli Defense Forces (IDF) launched the operation Iron Swords in retaliation.

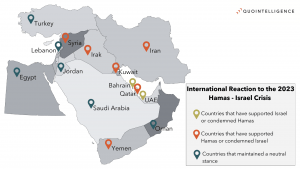

Figure 1 – International reaction to the 2023 Hamas – Israel crisis in the Middle East

Impact on the Region

In the Middle East, the security situation in Lebanon and Syria has deteriorated at the border with Israel, as Hezbollah aims to divert IDF resources from the targeting Hamas. Most countries in the region either adopted a neutral stance or condemned Israel. Notably, Saudi Arabia’s normalization negotiations with Israel were halted in the wake of the crisis. United Arab Emirates and Bahrain stand out for condemning Hamas.

Impact on the Global Economy

The volatility of the situation is fueling concerns over the possible expansion of the crisis to the broader region. The energy sector is particularly impacted by this situation as the cost of a barrel of crude is about 10 percent higher than it was before the Hamas attack. Previous conflicts in the region have caused significant disruptions in fuel supply. Notably, Israel’s counteroffensive in the framework of the Yom Kippur War in 1973 prompted an oil embargo from the Organization of Arab Petroleum Exporting Countries (OAPEC), which led to what is commonly referred to as the first oil crisis. Violent outbursts in the region are to be closely monitored as the Middle East and North Africa region accounts for about 50 percent of oil exports and 15 percent of natural gas exports worldwide¹. In turn, an increase in oil prices will likely feed inflation. Other commodities, such as gold, government bonds, global stocks, and the Israeli currency shekel will likely fluctuate because of the uncertainty arising from the conflict.

Impact on the Cyber Threat Landscape

- eCrime

Threat actors are likely to exploit the ongoing crisis in phishing and social engineering campaigns to lure their targets. QuoIntelligence assesses this represents the most likely and harmful threat for European companies arising from the ongoing crisis. - Hacktivism

Pro-Palestine and pro-Israel hacktivist groups are conducting distributed denial of service (DDoS) attacks, information leaks, web defacements, and doxing attacks. Israeli governmental sites are the primary targets of such attacks. As seen in the framework of the war in Ukraine, pro-Palestine hacktivist groups are also targeting countries supporting Israel, such as India, the UK, or the US. - State-sponsored activity

If they were to get involved in the framework of the Hamas–Israel crisis, Iranian APTs will likely conduct attacks against their usual targets which are Israel, Saudi Arabia, and the US.

QuoIntelligence closely monitors the geopolitical landscape to help its customers adapt their security posture in the face of cyber and physical threats. We provide finished intelligence through travel advisories and risk assessments to anticipate and prepare against such threats and keep your organization secure.

¹International Energy Agency, 25 May 2022: How producers in the Middle East and North Africa can free up more natural gas for exports

Keep up to date

To keep up with the latest cyber and geopolitical threats, subscribe to QuoIntelligence’s Weekly Intelligence Newsletter, published every Thursday around 1900 CET.