- High Risk of Unintended Escalation: Despite the lack of intent from Iran, Hezbollah, and Israel to escalate current tensions, the Middle East remains highly volatile with significant risks of unintended escalation into full-scale conflict.

- Limited Supply Chain Disruptions: Supply chains passing through the region are likely to continue to face disruptions. Impact on Western entities will likely be limited in time and scale, with enhanced diversification efforts to improve supply chain resilience.

- Rising Maritime Security Concerns: The Red Sea crisis constitutes new precedent in maritime security, with the Houthis’ attacks on merchant vessels potentially influencing other groups to use similar tactics on strategic waterways.

- Continued Market Uncertainty: The ongoing volatility in the Middle East will lead to sustained uncertainty, adversely affecting markets, and constraining investments and trade operations in the region.

- Growing Need For Geopolitical Risk Management: The situation underscores the importance for businesses to integrate geopolitical risks into their risk management plans. Staying informed and adapting to changing circumstances are crucial for maintaining resilience and continuity.

Broad Geopolitical Impacts:

The Axis of Resistance Poses a Reinforced Threat: The offensive, but more importantly Israel’s military response, has contributed to reinforcing the so-called Axis of Resistance led by the Irani regime and formed by the Syrian government, the Hezbollah in Lebanon, Yemen’s Houthi movement, multiple Palestinian militant groups. These proxies have themselves engaged in offensive actions against Israel and Israeli-linked entities:

Map: Iran’s Axis of Resistance

Mounting Tensions Israel – Lebanon: Since 8 October 2023, Hezbollah has been taking an active part in the crisis, attacking Israeli territory with rockets, mortar shells, and drones. Israel had to evacuate some areas located at the border with Lebanon and its military continues to conduct retaliatory strikes regularly.

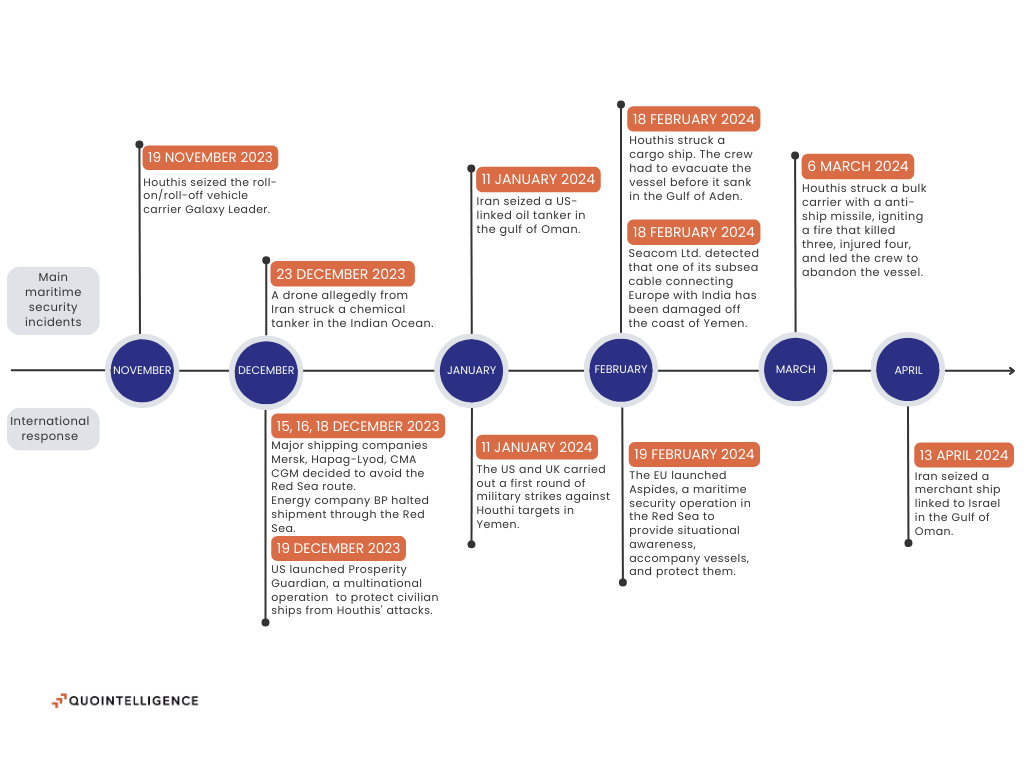

Red Sea Crisis: Since November 2023, Yemen’s Houthi rebels have persistently targeted merchant vessels in the Red Sea in reprisal for Israel’s military operation in Gaza. The movement seized a cargo ship in November and has conducted multiple drone and missile strikes since. Among its most notable attacks is the explosion of a drone boat packed with explosives in January. While the attack failed to cause any damage or casualties, it demonstrates the Houthis’ capability to use a wide range of attack vectors, with some degree of sophistication. In February, the insurgent movement struck a cargo ship leading it to sink, illustrating the danger the group poses to maritime traffic in the strategic waterway to the Suez Canal.

Timeline: Main Maritime Incidents In The Middle East Since October 2023 and International Response

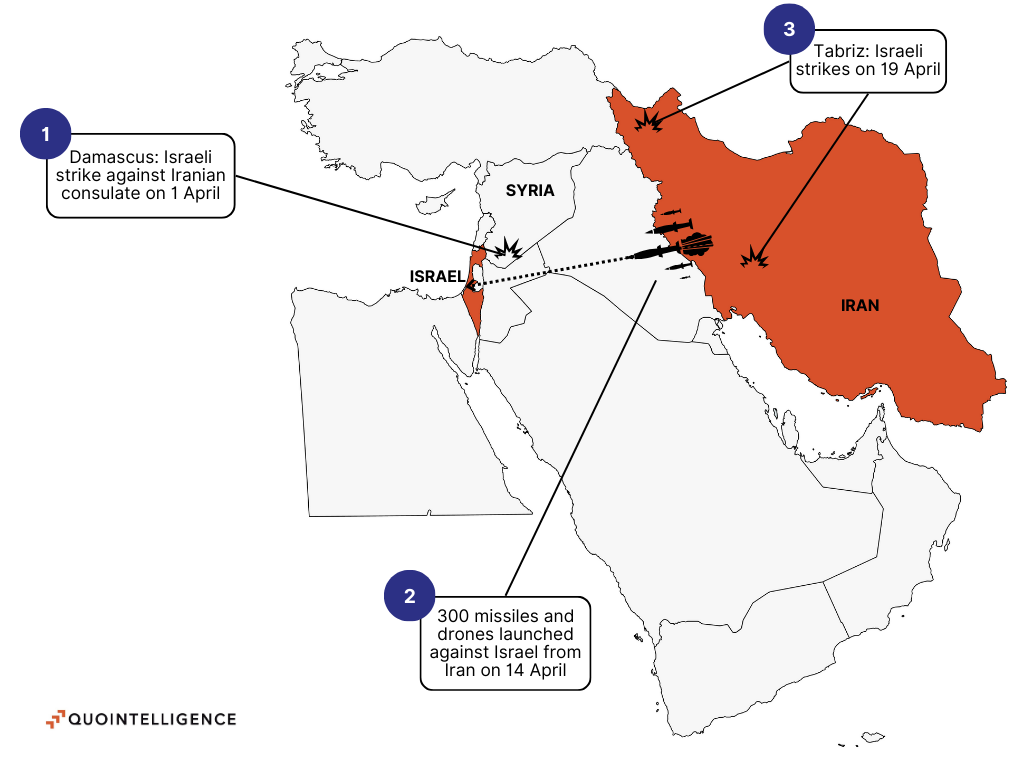

Increased Offensive Activity of Shia Militias In Syria and Iraq: In both Syria and Iraq, Shia militias backed by Iran have intensified their attacks against US bases. Similarly, the Golan Heights has become an intense arena of competition, with Shia militants sending drones and missiles over the territory. Iran is also using Syria as a hub of arms supply for Hezbollah. Since December, Israel has also intensified its response by increasing the frequency of its strikes on Syria’s airports in Damascus and Aleppo and the targeting of Iran’s Islamic Revolutionary Guard Corps-Quds Force. This dynamic culminated with the 1 April strike against the Iranian consulate in Damascus.

Map: Israel – Iran Attacks April 2024

Impacts For Businesses:

Reshaping Shipping Dynamics: Due to Houthis’ attacks against merchant vessels in the Red Sea, major shipping companies have decided to avoid the waterway to the Suez Canal to instead sail around Africa, incurring additional costs for ocean carriers. As of 18 April, freight rates on Shanghai to Rotterdam are 86 percent higher when compared with the same week last year, according to maritime consultancy Drewry’s World Container index.2 Additionally, the situation is affecting the traffic in eastern and central Mediterranean ports as more shipping companies are heading directly to Northern Europe after sailing around Africa, therefore bypassing the Mediterranean Sea. Italian port authorities worried sea traffic coming from the Suez Canal and destined for markets in Europe will significantly decrease amid continued Houthi attacks in the Red Sea.3 In opposition, western Mediterranean ports are experiencing a significant increase in traffic. In fact, Morocco’s Tanger Med port reported a record 13.4 percent annual increase in container volumes handled in 2023.4

Insurance: Rising Premium And New Coverage Restrictions: The growing tensions in the Middle East have led insurers to require their clients operating in the region to pay an additional premium. In particular, insurance costs for ships sailing through the region have increased significantly since the beginning of the Red Sea crisis. Beyond businesses, the demand for political violence insurance among individuals has also surged leading to higher prices.

Adaptation Of Global Supply Chains To Reduce Risks: About 12 percent of world trade passed through the Suez Canal before the Red Sea crisis. As such, global supply chains are directly impacted by the degradation of security in the area, in particular for supply chains between Asia and Europe. The automotive and retail sectors in Europe and the US have already experienced some brief disruptions due to delays in the supply of some products. In the medium term, the situation will likely drive the adaptation of global supply chains, with longer supply cycles, near-shoring, and reliance on multiple suppliers.

Energy Supplies: Growing Risks, Low Impact For Now: The Middle East accounts for about 30 percent of global oil production. As such, amid increasing tensions in the region, energy supply chains face growing risks. As of May, there has been little to no impact on energy prices so far, due to weak demand and alternative sources of supply located out of the region. Nevertheless, the International Monetary Fund (IMF) has warned5 that a full-scale conflict in the Middle East could have adverse effects on the energy sector with higher oil prices and ripple effects on the inflation and financial markets. In fact, in case of conflict, Iran would be in the capacity to disrupt oil shipping on the Strait of Hormuz, where 15-20 percent of the world’s supplies flow through. Tehran has already seized commercial ships in the Gulf of Oman. Since October 2023, Iran has notably seized a US-linked oil tanker in January and an Israeli-linked container ship in April.

Outlook and Recommendations:

Escalation Risk: As of May, we assess that neither Iran, the Hezbollah, nor Israel want to further escalate the current tensions. Nevertheless, the Middle East is experiencing a highly volatile situation and as such, risks of unintended escalation into a full-scale conflict are high.

Market Disruption: The volatility of the security situation in the Middle East will continue to translate into uncertainty with adverse effects on the markets, restraining investments and trade operations in the region.

Supply Chain Disruption: Supply chains transiting through the region are likely to face some sort of disruptions, likely limited in time and scale. This will contribute to supply chain diversification to enhance resilience.

Maritime Security: The Red Sea crisis has set a precedent for maritime security. In fact, the example set by Houthis’ attacks on merchant vessels will possibly influence other armed groups or movements located on strategic waterways to leverage maritime security to defend their interests.

The situation has once again underscored the growing need for businesses to consider geopolitical risks in their risk management plan. Adapting to changing circumstances, staying informed, and implementing robust risk management strategies are imperative for companies seeking to maintain resilience and continuity in this challenging geopolitical landscape.

Below, we provide five key recommendations for companies operating or with interests in the Middle East:

Ensure Employee Safety: To ensure the safety of your employees, it is crucial to implement a comprehensive security strategy. This includes providing prior security training, such as Hostile Environment Awareness Training (HEAT), for individuals who are assigned to work in sensitive areas. Additionally, it is essential to establish updated and reliable communication protocols to maintain constant contact with employees who are located abroad. It is also important to monitor and adhere to local government advisories, and to review and potentially restrict travel to high-risk zones.

Risk Assessment: Conduct a comprehensive risk assessment tailored to your business and operations. This assessment should analyze all aspects of the company’s operations that could be impacted by regional instability. This includes identifying vulnerabilities in physical assets, personnel, cyber infrastructure, and supply chains. Threat intelligence reports serve as a crucial resource for organizations seeking to gain valuable insights into potential security threats and vulnerabilities. By analyzing and synthesizing data from various sources, these reports enable organizations to make informed decisions and develop a strategic response plan to mitigate risks.

Supply Chain and Logistics: Prepare for disruptions in supply chain and logistics by identifying alternative suppliers and transportation routes that are less likely to be affected by the irruption of a conflict. Consider increasing the inventory of critical supplies or diversifying your supplier base to reduce dependence on affected regions. Furthermore, communicating closely with logistics partners to get real-time updates on potential disruptions is also essential.

Business Continuity Plans: Review and update your business continuity plans to address potential disruptions and ensure the ability to maintain essential operations. This includes identifying critical operations that must continue without interruption and implementing fail-safes or redundancies for these areas. It is also essential to train staff to handle emergencies and conduct regular drills to ensure readiness.

Compliance: Ensure compliance with any legal or regulatory changes related to the conflict that may impact your business operations. This requires staying informed about new legislation and regulatory updates. Engage with legal experts to determine how these changes affect your operations and implement necessary adjustments in their compliance frameworks.

- BfV, A2, 29 November 2023, Effects of the HAMAS terrorist […]

- Drewry, B2, 22 April, World Container Index – 18 April

- Reuters, B2, 17 January, Italian ports fear blow to business […]

- Altayar, C2, 31 January, Tangier Med signs its 2023 annual report […]

- IMF, A2, 24 April, Regional Economic Outlook – The Middle East […]