This analysis first appeared in our Weekly Intelligence Snapshot. Subscribe now to receive weekly Intelligence on the geopolitical and cyber threat landscape

Countries are implementing new frameworks to ban diesel and petrol cars in the coming 10 to 15 years to reduce CO2 emissions, with tougher CO2 frameworks likely to extend to most countries.

To reduce CO2 emissions, demand for Electric Vehicles (EVs) – as well as for the batteries, semiconductors, and raw materials used to develop them – will increase.

Further increasing demand, customers are signaling a willingness to switch to EVs: in a recent survey, 41 percent said they will consider an EV as their next vehicle.

As a result, we expect increased competition and industrial espionage in related sectors.

Additionally, the increased importance of EVs and batteries can lead to geopolitical tensions, as reliance on China, the world’s largest producer of raw materials used in batteries, will likely grow.

Update: On August 20, Toyota announced that they are to slash worldwide vehicle production by 40% in September due to the global microchip shortage.

Electric Vehicles to usher in a new, climate-neutral Europe

Brussels is the latest city to announce that it will ban diesel cars from 2030 and petrol vehicles from 2035. The announcement aligns with the EU’s efforts to reduce CO2 emissions and create a climate-neutral Europe by 2050.

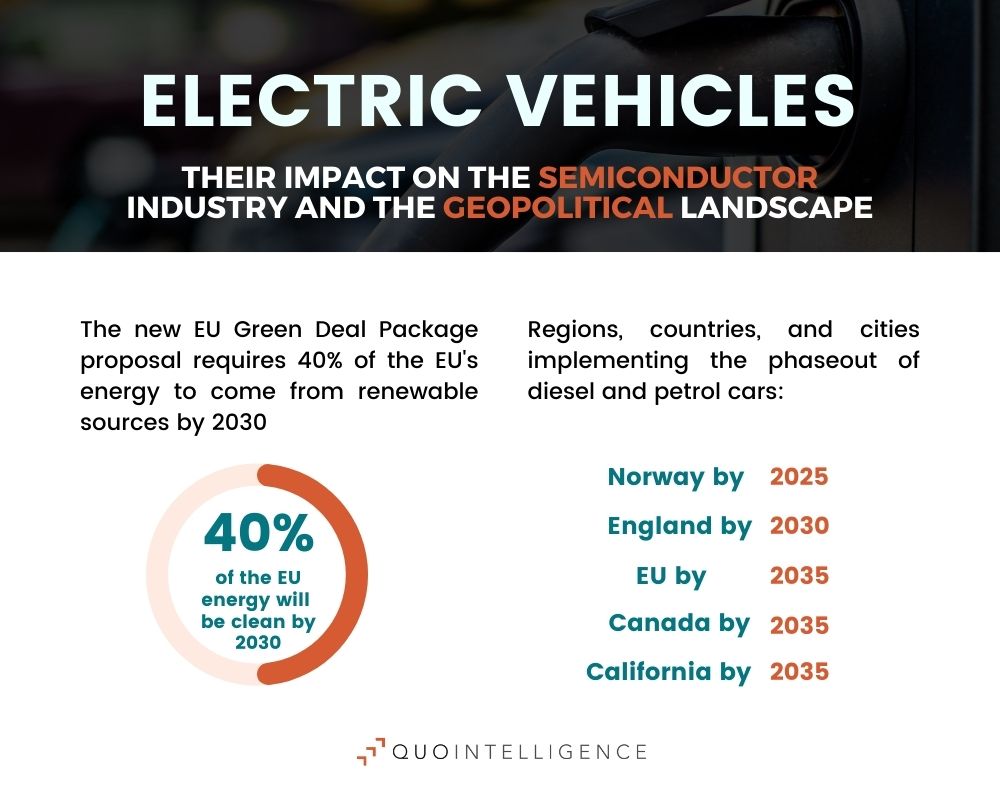

To reach this goal, the EU proposed a new green deal package on 14 July that will require the phaseout of petrol and diesel engines by 2035 and 40 percent of the EU’s energy to come from renewable sources by 2030.

Other countries are also implementing similar frameworks. For example, petrol and diesel-powered cars and vans will no longer be sold in the UK from 2030, Norway from 2025, and in parts of the US (California) and Canada from 2035. Similarly, the US Energy Department said on 14 June that it would provide EUR 168 million (USD 200 million) in funding to support EV and battery-related research.

More countries, including the largest global consumer markets, are either implementing or considering frameworks to reduce CO2 emissions. As the trend of tougher CO2 standards is growing, we have analyzed their implications over the medium term so your organization can prepare for likely changes.

What does this mean for the Semiconductor Industry?

Increased Semiconductor Demand: Semiconductors are necessary for batteries, power trains, and are key for EV firmware and autonomous driving. As the demand for EVs is likely to grow following CO2 policies, and since planned EV investments increased by 41 percent in 2020 to EUR 278 billion (USD 330 billion), the industry is likely to demand more semiconductors.

Given this prospected increase in demand, the shortage in semiconductor supply could further worsen.

Increased Funding for Semiconductor Research and Investment: Green policies are pushing the need to further develop EVs, including more batteries with improved efficiency, which will require a major breakthrough in semiconductor technology.

As such, countries will increasingly invest in these technologies to develop the latest chips that can drive the growing green industry.

How will EVs impact the geopolitical landscape?

Growing competition between nations: New frameworks and R&D investments to reduce CO2 emissions are likely to increase competition between nations to develop compliant technologies. Competition is expected in strategic industries, such as semiconductors, and industries developing technologies or providing raw materials for cleaner energy.

High competition in developing sectors such as EV and clean energy can lead to restrictions against foreign takeover in critical industries, potentially restricting globalized supply chains and further leading to supply shortages.

Increased espionage: Countries will try to secure their energy supply and become industry leaders in green technology and of related technology and materials.

However, increased competition in industries powering the green transition will likely lead to industrial espionage as countries race to develop the latest chips and technologies. As key threat actors are influenced by economic development policies, the energy sector will continue to be a target for espionage.

Additionally, the governments developing policies and restricting fossil fuels could also become an important target for espionage campaigns. Any nation seeking to understand coming regulations, restrictions, and new investment in technologies driving the industry will be tempted to target those that have already done the legwork.

For instance, last year, Norway’s Police Security Service (PST) released a report warning about cyberespionage campaigns targeting Norway’s petroleum industry to gain information on oil and gas technology as well as on oil production regulations. Russia and China were cited as particular threats. The report also claims that renewable energy could become a focus in future espionage campaigns.

Nations will try to secure their EV supply chain: Given the growing importance of batteries, countries will seek to secure the supply of lithium-ion batteries, and the raw materials they are made of, such as lithium, nickel, cobalt, and graphite.

Nevertheless, for now, China controls most of the world’s mining and processing of minerals used in batteries, which could result in nations relying increasingly on China for the development of batteries used in EVs.

Clean Energy: A new Strategic Frontier

As tougher CO2 frameworks will likely extend to most countries in the coming 10 to 15 years, batteries and EVs will likely become a strategic issue. Most nations will have to find alternatives for fossil fuels, and these green policies are already fostering investment and R&D on EV and clean energy such as hydrogen.

QuoIntelligence expects continued competition among world powers in key areas for the development of EV and other emerging technology that is likely to result in industrial espionage as well. These areas include batteries, semiconductors, and raw materials.

Additionally, despite countries trying to secure their batteries’ supply chain, China controls most of the world’s mining and processing of raw materials used in batteries. This could result in nations becoming increasingly dependent on China for batteries and EV technology.

The importance of Risk Intelligence to understand changing regulation and mitigate espionage threats

The latest policies and R&D investment in the green industry, together with governments increasingly considering climate change as a security threat, will highly likely impact the geopolitical landscape in the medium and long term. That, in turn, will likely impact the cyber threat landscape as well, for example, Advanced Persistent Threat (APT) groups backed by nation states targeting key industries.

Read more here on how Geopolitcal tensions impact Cybersecurity.

At QuoIntelligence, we provide strategic analyses that integrate geopolitical and risk assessments. As part of our methodology, we assess relevant threats to our customers and identify which threats are most likely to target them. Based on these assessments, we create likely attack scenarios and provide support in closing identified security gaps. By doing this, our customers are better prepared for potential threats, both direct and indirect, to their organization.

Additionally, our Risk Intelligence offering consists of:

- Monitoring for potential disruptions to customer supply chains

- Addressing third-party risks

- Forecasting changes to the threat landscape impacted by upcoming regulations

Did you enjoy this story?

In our Weekly Intelligence Snapshot, we cover even more original research and underground news.

Subscribers can access the complete Intelligence Snapshot as opposed to only the summary. The full version includes detailed information on threat actors, vulnerabilities, patches, IoCs, and recommended actions.